How Much House Can You Afford?

Less than a week ago the Denver Post reported that the average home price topped $725K for the first time EVER. And the median home price for a single-family home reached $600,000 in June – another first — meaning that half of the homes sold above that price and half below. For condos and townhomes – AKA paired offerings — the median sales price was unchanged from May at $380,000 – but that’s up 16.9 percent over the past year.

While the crazy bidding wars for houses on the market in the Denver metro area have slowed down, buying a house is still one of the most important financial decisions you’ll ever make. And if you’re house hunting, it’s good to know beforehand how much house you can afford. While all those other must-haves matter, the ultimate cost of the house you buy needs to include more than just the principal and interest of your mortgage payement.

Qualifying for a Home Loan

Before you start shopping for your new home, find out ALL the things you’ll have to pay for up front. You don’t want to be a “house-poor” home buyer, whose mortgage payments totally zap your monthly income.

A mortgage lender may suggest that you qualify for the highest loan amount possible since their goal is boosting profits not ensuring you have a comfortable mortgage payment. Obviously the more you borrow and the longer your loan, the more interest you pay and who benefits from THAT? Take into account the numbers they look at to gauge affordability, and then add in the variables.

Ratio Formulas and Add-ons

The formulas that banks use to set an approved amount focus on a few numbers, like a “debt to income ratio,” and “mortgage payment ratio”.

To calculate a Mortgage Payment Ratio, the rule of thumb is that your monthly mortgage payment should not exceed 28 percent of your gross monthly income. For example, if you and your spouse bring in a total gross income of $100,000, your monthly mortgage payment shouldn’t exceed $2,300 which is 28 percent of $100K. (Mortgage Calculator)

Lenders also look at your Debt-to-income Ratio (DTI), which should generally stay below 36 percent (although some lenders will go higher). Your debt includes your future mortgage payment, any car loans or student loans, and minimum credit card payments. So, if you and your spouse bring in a gross income of $100,000 a year, you shouldn’t be spending more than $3000/month on TOTAL debt.

Hidden Homeownership Expenses

Here’s why all that matters. What banks don’t take into account when they come up with these 28/36 rules are things like closing costs you’ll pay (three-to-five percent of a home’s value) in addition to your 20 percent down payment. Other costs they don’t factor in but you should are moving expenses, furniture you might need, and utility deposits. Also add in expenses like childcare, landscaping and yard maintenance, and utilities.

Banks also aren’t interrogating your spending habits (food, gas, entertainment, clothes, household supplies, transportation, etc.) when they loan you money. Getting that magic “approved at” number is the first step, but there’s still some math homework to be done to figure out the numbers that leave you some wiggle room for the unexpected.

Analyze your budget for the last three months and determine all the fixed, recurring monthly expenses – then use a mortgage calculator to get your payments below 30 percent of your income – the amount Motley Fool recommends.

Evaluating More or Less Stress

Is the monthly payment one you can make without stressing about making ends meet? Will you feel panicky juggling expenses and payments? Will your retirement suffer? Are you secure in your current income? Do you foresee any additional/substantial expenses in the near future (one to three years)? If you’re starting a family or planning to, those are some expenses you should factor in now, too.

The hardest but most important part of the “how much house can I afford” exercise is being honest about money going out and money coming in. At the end of the day, you want your new home mortgage to work for your budget, and not force your budget to work for your mortgage!

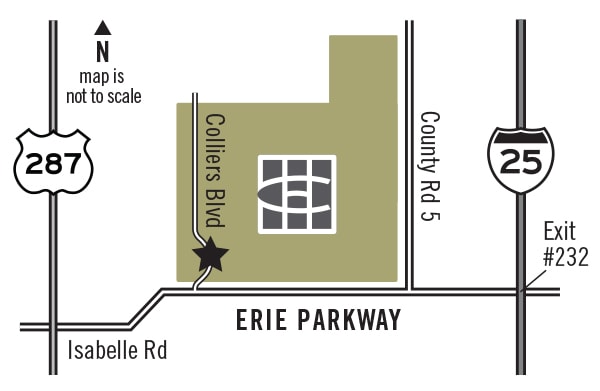

Buying a House in Colliers Hill

One of the great things about buying a new home in the master-planned community of Colliers Hill is that there’s never a bidding war, and the options are plentiful, in terms of builders, floor plans and design options. Most builders have affiliate mortgage lenders that can help you navigate the home-buying process, too, so visit the beautiful single-family model homes from Century Communities and Richmond American Homes, and the gorgeous paired product from KB Home. Priced from the $400s, this fast-growing new home community in Northern Colorado has lots of exciting amenities for families, empty-nesters, couples and singles!